StructureIQ’s AI-Powered Solution for Commercial Property Insurance Underwriters

The Value of StructureIQ to Underwriters

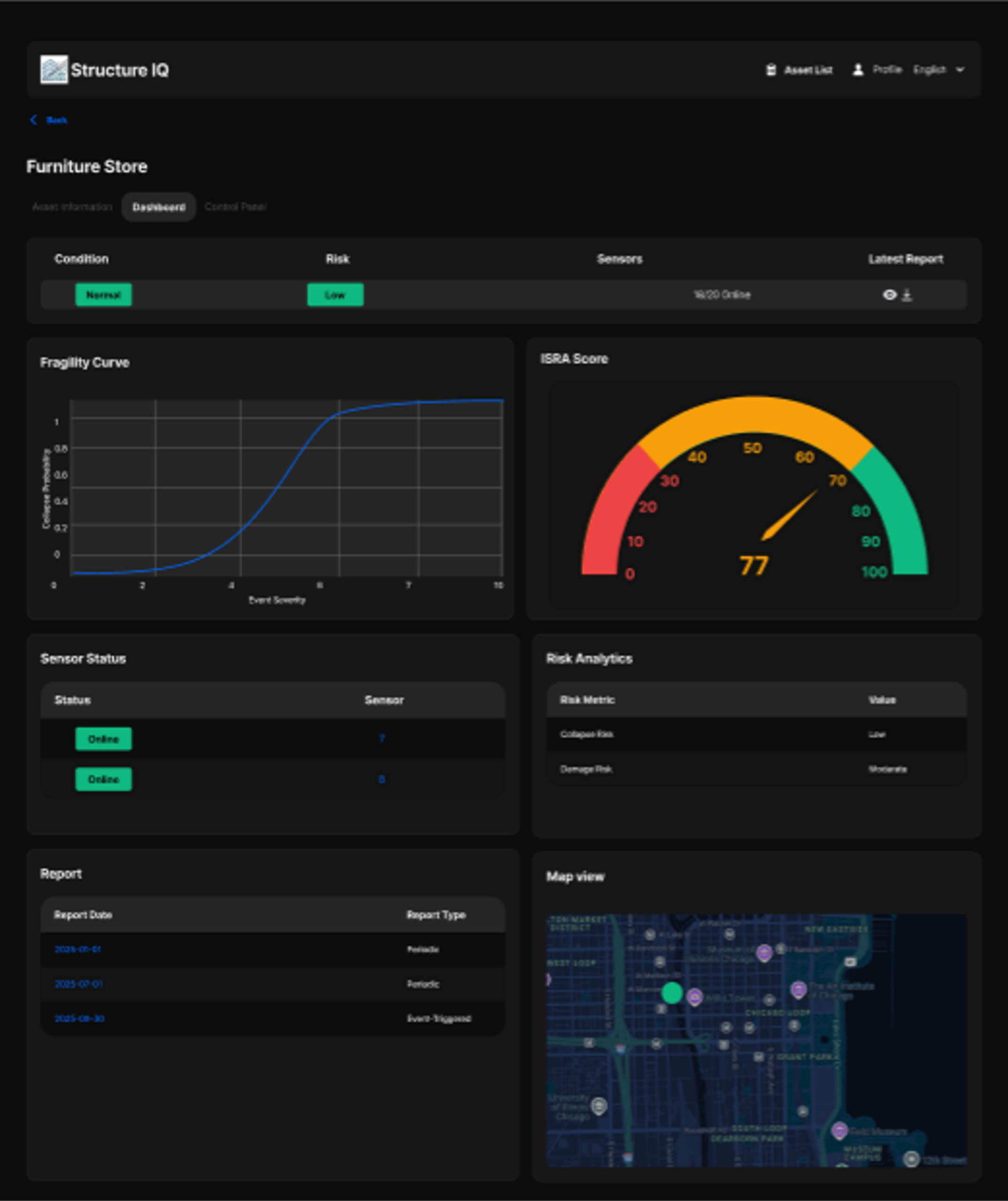

StructureIQ provides underwriters with building-level structural performance data that improves rate adequacy, reduces loss ratios and claims expenses, and strengthens portfolio accumulation control. By establishing condition baselines, delivering real-time exception alerts, and reporting post-event structural changes, StructureIQ enables more accurate underwriting, proactive risk management, and faster, cleaner claims outcomes.

Contact us for a 90 day trial: info@structureiq.ai

Download our brochure

Problem statement in COPE terms

Underwriters typically bind with standard submission data that includes Construction, Occupancy, Protection, and Exposure (COPE) data and incomplete secondary modifiers on the structural condition of the risk, missing critical data that ultimately drives:

- Adverse selection at submission (unknown deterioration hidden in averages).

- Inadequate Pricing & Systematic underpricing where vulnerability is worse than class norms.

- Portfolio of risks with high Probable Maximum Loss and accumulation hot spots.

- Higher Loss Adjustment Expenses from causation disputes due to missing pre-loss baselines.

Avoiding Financial Risk

This information gap has severe financial consequences for insurers:

- Adverse Selection: Properties with poor structural conditions are more likely to seek insurance, while well-maintained properties may self-insure or opt for minimal coverage.

- Mispriced Risk: Without accurate structural data, premiums are based on broad averages rather than individual building conditions, systematically underpricing properties with higher risk.

- Loss Ratio Deterioration: Unknown structural risks inflate loss ratios and reduce profitability, undermining the benchmarks insurers use to optimize pricing strategies.

- Claims Disputes: Lack of baseline structural data complicates causation determination, resulting in costly investigations, litigation, and settlements.

- Portfolio Concentration Risk: When insurers cannot identify structurally compromised buildings, they unknowingly accumulate concentration risk within properties that are deteriorating.

The Solution

Structural Health Monitoring Supporting the Underwriting Process

Structural Health Monitoring (SHM) is a technology-based system that continuously tracks the condition of a building’s critical structural components in real-time, using installed on-site sensors that communicate with an application and deliver formatted data to underwriters for incorporation into the submission and bind workflows.

Submission/Bind Workflow

- During submission: Baseline sheets support risk selection, schedule credits/debits, and tailored terms (maintenance warranty, deductible structure) on structures with existing SHM tech or an underwriting requirement on risk that exceed certain thresholds to install SHM solution

- In-force: Deterioration alerts trigger engineering referral and loss control actions; portfolio roll-ups expose accumulation by peril and condition.

- Post-event: time-stamped deltas distinguish between pre-existing and event-caused damage for coverage and subrogation, reducing LAE and cycle time.

The Cost-Effective SHM Solution Built for the Insurance Industry

StructureIQ’s Structural Health Monitoring (SHM) technology fills a crucial information gap by providing insurance underwriters with continuous, objective, building-specific data on structural performance, by deploying wireless sensors that monitor vibration, movement, tilt, and other structural indicators, and delivering that data in a format that serves the insurance industry’s needs.

Underwriting lever mapping

- Tilt, drift, modal frequency, baselines, credible secondary modifiers, and vulnerability adjustments.

- Change detection: Referral rules and inspection SLAs.

- Event deltas: First Notice of Loss (FNOL) triage, faster coverage decisions, and fewer disputes.

- Portfolio analytics : accumulation and treaty reporting.

Implementation & SLAs

- Scope: Typical site uses 2–3 wireless sensors and a cellular gateway; no IT integration required.

- Cadence: Baselines at install; exception alerts continuously; monthly risk memos; event delta report within 24–72 hours.

- Governance: Time-sync, tamper logs, encrypted data, defined retention, and audit trail to support evidentiary use.

Contact us for a 90-day trial: info@structureiq.ai

Run a 90-day pilot with StructureIQ on 10–25 buildings. We provide baseline sheets, alert thresholds, one simulated or real post-event delta report, and a portfolio memo suitable for underwriting committee review. The question is no longer whether insurers need structural health data; it’s how quickly they can deploy monitoring solutions to protect their portfolios and gain a competitive advantage in an increasingly challenging market.