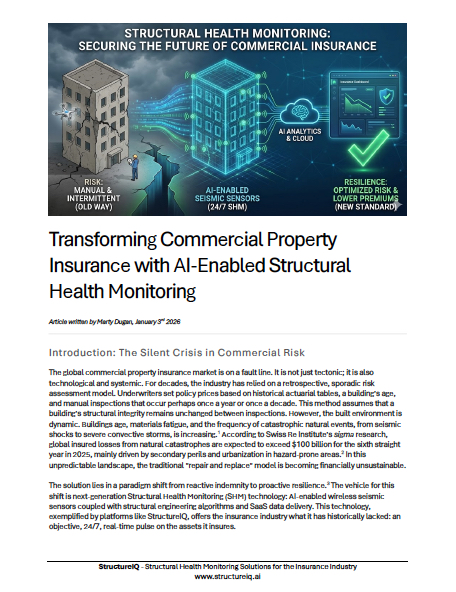

Transforming Commercial Property Insurance with AI-Enabled Structural Health Monitoring

The commercial property insurance industry is facing unsustainable financial risks due to outdated, sporadic inspection models and increasing natural disasters, necessitating a shift to next-generation Structural Health Monitoring (SHM). Unlike subjective manual or drone inspections, SHM utilizes AI-enabled wireless sensors to create a “digital twin” that provides 24/7, real-time data on a building’s internal structural integrity. This transition to objective, continuous monitoring enables a proactive approach that reduces loss ratios, minimizes business interruption, and optimizes premiums by detecting damage before it becomes catastrophic.

The Future of Commercial Property Underwriting: How AI-Powered Structural Health Monitoring is Reshaping Risk Assessment

Commercial property insurance underwriting is facing growing challenges from aging infrastructure, rising catastrophe losses, and the limitations of traditional, inspection-based risk assessment. This article examines how AI-powered Structural Health Monitoring (SHM), enabled by affordable wireless sensor networks and cloud-based analytics, is transforming underwriting from a retrospective, assumption-driven process into a continuous, data-driven discipline. By providing real-time visibility into structural performance, SHM delivers actionable risk intelligence that improves pricing accuracy, loss ratios, claims efficiency, and customer engagement. The article explores the economic feasibility of modern SHM through subscription-based models, its integration into underwriting and claims workflows, and the competitive advantages it offers insurers willing to adopt early. It concludes that continuous structural monitoring is poised to become a foundational capability in commercial property insurance, reshaping how risk is assessed, managed, and priced.